*Requires purchase of precious metals. Free metals represent actual metals up to 1% of the purchase price of non bullion products. Call for details. Subject to change at any time.

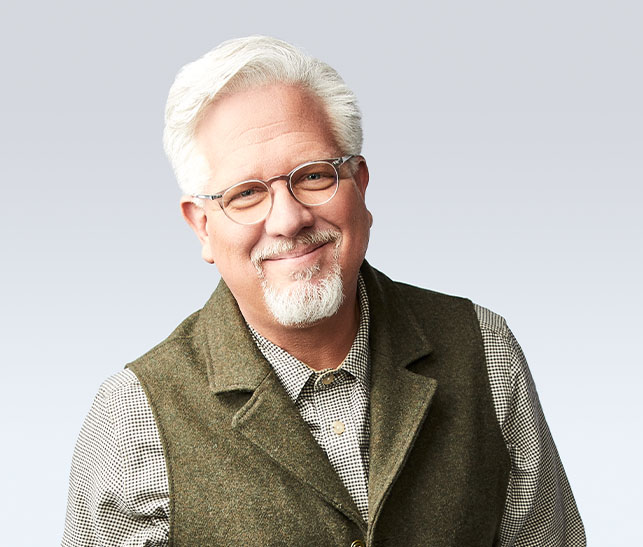

*Glenn Beck is a Lear Customer and Paid Spokesman

Information contained within Lear Capital sites and publications is for general educational purposes and should not be construed as investment advice. Lear Capital does not provide legal or tax advice, or retirement-specific recommendations.

Copyright © LearCapital.com. All rights reserved. Contact Us